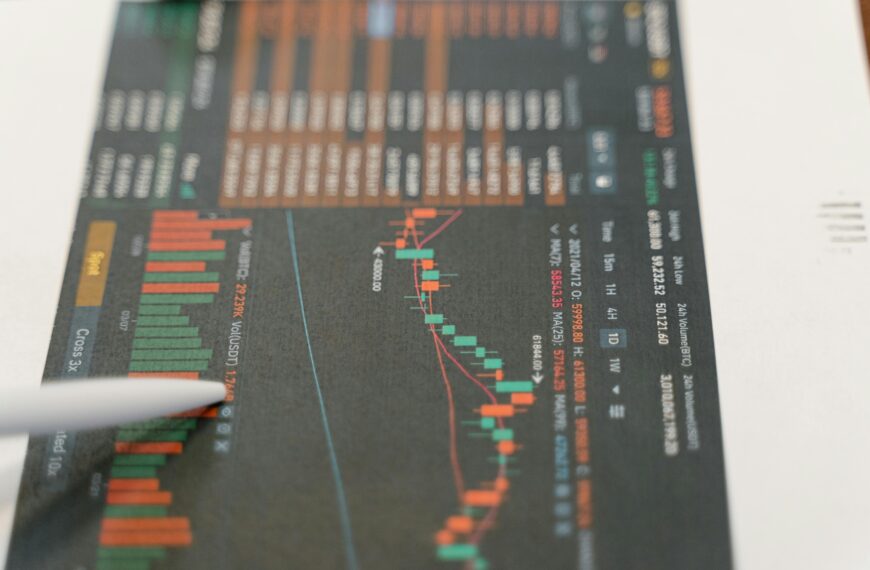

Spot, Margin, and Futures Trading — Explained Simply for Beginners

Introduction

If you’ve just entered the crypto world, you’ll often hear traders talking about spot, margin, and futures trading. These are three different ways to buy, sell, or speculate on cryptocurrencies — and each has its own risk, reward, and purpose.

In this article, we’ll break them down in simple terms so you can understand how they work and which one suits you best.

🪙 1. What Is Spot Trading?

Spot trading is the simplest and most common form of crypto trading.

How it works:

You buy or sell crypto directly at its current market price (“on the spot”). Once the trade is completed, the crypto becomes yours instantly.

Example:

You buy 1 Bitcoin at $60,000 — you now own that Bitcoin and can hold, transfer, or sell it anytime.

✅ Advantages:

- You fully own your crypto.

- No risk of liquidation.

- Great for beginners and long-term investors.

⚠️ Disadvantages:

- Profits depend only on price increasing.

- No leverage, meaning smaller gains (but also lower risk).

⚡ 2. What Is Margin Trading?

Margin trading allows you to borrow money from an exchange to increase your position size.

How it works:

You deposit a small amount (called margin) and borrow extra funds to trade larger volumes.

For example, with 10× leverage, your $100 can control $1,000 worth of crypto.

Example:

You open a 10× long position on BTC at $60,000.

If BTC rises 5%, your profit is not $5 but $50 (because you traded with 10× power).

✅ Advantages:

- Amplified profits from small price moves.

- Flexible: you can trade both rising (long) and falling (short) markets.

⚠️ Disadvantages:

- If the market moves against you, losses are also amplified.

- Your position can be liquidated (force-closed) if losses exceed your margin.

- Not recommended for complete beginners.

🔮 3. What Is Futures Trading?

Futures trading is about contracts rather than real crypto ownership. You agree to buy or sell crypto at a future date or price.

Types of Futures:

- Perpetual Futures: No expiry date (most common on Binance, Bybit, etc.).

- Dated Futures: Expire at a specific date.

How it works:

If you believe BTC will rise, you open a long position; if you think it will fall, you open a short position.

You can use leverage (like margin) and trade without holding the actual coin.

Example:

You open a 5× long BTC futures contract at $60,000.

If BTC goes to $63,000 (+5%), you make +25% profit because of the 5× leverage.

If BTC drops 5%, you lose 25%.

✅ Advantages:

- Profit in both rising and falling markets.

- Powerful for experienced traders.

- No need to hold actual crypto (just contracts).

⚠️ Disadvantages:

- High risk and fast losses if unmanaged.

- Requires deep understanding of leverage and liquidation.

⚖️ 4. Key Differences Between Spot, Margin & Futures

| Feature | Spot | Margin | Futures |

|---|---|---|---|

| Ownership | You own crypto | You own borrowed crypto | You trade a contract |

| Leverage | No | Yes (2×–10× or more) | Yes (up to 100×) |

| Risk Level | Low | Medium–High | Very High |

| Best For | Beginners & holders | Intermediate traders | Experienced traders |

| Profit Direction | Only when price rises | Long & Short | Long & Short |

💡 5. Which Type Should You Choose?

- New to crypto? Start with Spot trading. It’s simple and safe.

- Some experience? Try Margin trading with small leverage (2×–3× max).

- Pro level & high risk tolerance? Go for Futures, but manage risk wisely.

🧭 6. Pro Tips for Safe Trading

- Always use Stop-Loss orders.

- Never trade with emotions.

- Avoid over-leverage.

- Learn with demo accounts first.

- Read daily market news — like on DotOpinion 😉.

🏁 Conclusion

Each trading type — Spot, Margin, and Futures — offers different levels of risk and reward.

Start small, understand how markets move, and never trade more than you can afford to lose.

At DotOpinion, our mission is to make crypto education simple and practical — helping you trade smarter and safer in the digital economy.