Crypto Classification: The Coin Chaos — Simplified

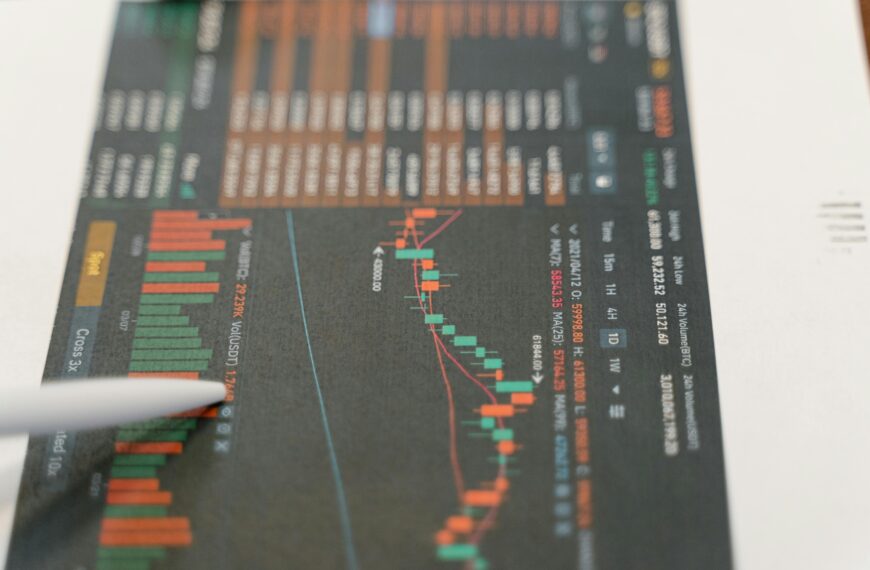

In the vast world of cryptocurrency, not all coins are created equal. Some lead the digital finance revolution, others ride trends, and a few are pure fun.

To make sense of it all, investors often classify coins into tiers, levels, and categories — each showing how strong, useful, or speculative a coin really is.

Let’s break down the crypto hierarchy so you can understand where your favorite coins stand. 🚀

⚔️ 1. Tier Classification of Coins

The tier system ranks coins based on their market capitalization, adoption rate, stability, and utility.

🏆 Tier 1 – The Blue-Chip Giants

These are the most trusted, time-tested coins — often the backbone of the crypto ecosystem.

Examples: Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Solana (SOL)

Traits:

- Large market capitalization

- High liquidity and adoption

- Proven technology and use case

- Institutional trust and backing

💡 Think of them as “Apple” and “Microsoft” of the crypto world.

⚙️ Tier 2 – The Strong Contenders

These coins show great potential and often power new technologies or decentralized ecosystems.

Examples: Avalanche (AVAX), Polkadot (DOT), Chainlink (LINK), Cardano (ADA)

Traits:

- Innovative blockchain solutions

- Growing communities and partnerships

- Medium-to-high volatility

💡 These are the “rising stars” — not yet giants, but aiming big.

🚀 Tier 3 – The Emerging Projects

These are early-stage coins with high risk and high reward potential.

Examples: Render (RNDR), The Graph (GRT), Sui (SUI), Arweave (AR)

Traits:

- Small market cap

- Developing ecosystems

- Often speculative or experimental

💡 Like investing in startups — exciting but risky.

🔢 2. Level Classification of Coins (By Use Case)

🧩 Level 1: Blockchain Base Layer Coins

These are the foundation coins that power their own blockchains.

Examples: Bitcoin, Ethereum, Solana, Avalanche, Cardano

Purpose:

- Provide infrastructure for decentralized apps (dApps)

- Enable token creation and smart contracts

- Focus on scalability and security

⚡ Level 2: Scaling & Utility Solutions

These are built on top of Level 1 blockchains to improve speed, scalability, and usability.

Examples: Polygon (MATIC), Arbitrum (ARB), Optimism (OP)

Purpose:

- Reduce transaction fees

- Increase transaction speed

- Bridge networks for better interoperability

😂 3. Meme Coins: The Fun (and Risky) Side of Crypto

Meme coins are born from internet culture — often without any major utility, but backed by viral communities.

Examples: Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE)

Traits:

- Driven by hype and community memes

- High volatility

- Sometimes evolve into utility projects later

💡 Meme coins show how community energy can turn a joke into a market mover.

🧠 4. Application-Based Coins: Real-World Utility

These coins have specific use cases beyond trading.

💳 Payment Coins: Used for direct transactions

Examples: Bitcoin (BTC), Litecoin (LTC), Dash (DASH)

☁️ Infrastructure Coins: Power blockchain networks

Examples: Ethereum (ETH), Solana (SOL), Avalanche (AVAX)

🔐 Privacy Coins: Focus on anonymity and security

Examples: Monero (XMR), Zcash (ZEC)

🛒 DeFi Tokens: Drive decentralized finance ecosystems

Examples: Uniswap (UNI), Aave (AAVE), Maker (MKR)

🎮 GameFi & Metaverse Tokens: Used in gaming and digital worlds

Examples: Decentraland (MANA), Axie Infinity (AXS), Sandbox (SAND)

🧭 Conclusion: Choose Your Coin Wisely

Understanding crypto tiers and classifications helps you invest with confidence — not just emotion.

Whether you’re holding Tier 1 blue chips for stability or exploring Tier 3 innovations, always research the project’s utility, community, and long-term vision before investing.

💡 Pro Tip:

Diversify your portfolio — mix some Tier 1 security with Tier 2 growth and a tiny bit of Tier 3 innovation.

Start your Trading Now!

⚠️ Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered financial or investment advice. Cryptocurrency trading and investing involve high risk and may not be suitable for all investors. Always do your own research and make decisions based on your personal financial situation. DotOpinion and its authors are not responsible for any financial losses incurred.