Introduction

Bitcoin is the world’s first decentralized digital currency — a revolutionary form of money that exists only online. Created in 2009 by an anonymous figure known as Satoshi Nakamoto, Bitcoin allows people to send and receive payments anywhere in the world without relying on banks or governments.

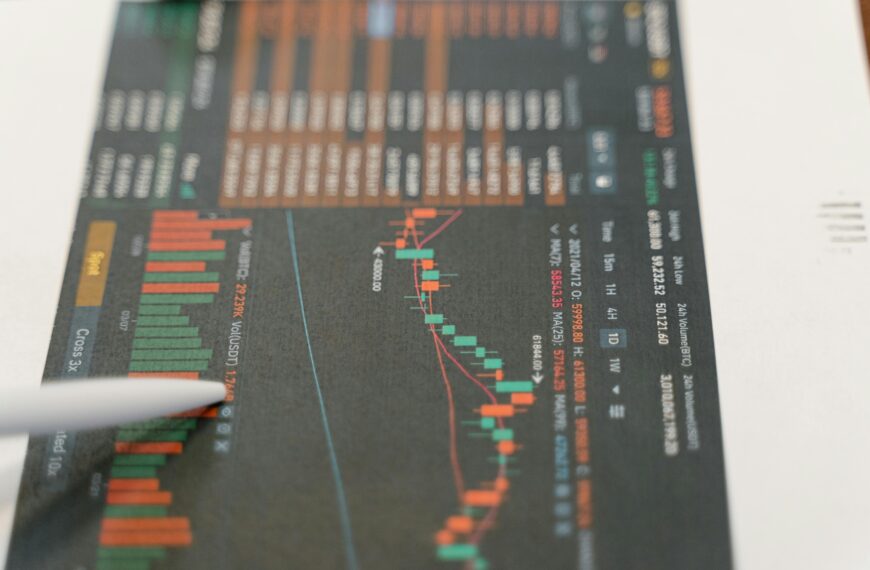

Binance Bitcoin$78,555.091.71%

Binance Bitcoin$78,555.091.71%

How Bitcoin Works

Bitcoin operates on a technology called Blockchain, which is a public digital ledger. Every Bitcoin transaction is recorded and verified by a network of computers called nodes. This makes Bitcoin transparent, secure, and nearly impossible to counterfeit.

- Blockchain: Stores all Bitcoin transactions permanently.

- Mining: The process of verifying transactions and adding them to the blockchain in exchange for new Bitcoins.

- Wallets: Digital tools that store private keys and allow users to send or receive Bitcoins safely.

Key Features of Bitcoin

- Decentralization: No single authority controls Bitcoin — it’s powered by a peer-to-peer network.

- Limited Supply: Only 21 million Bitcoins will ever exist, making it a deflationary asset.

- Transparency: Every transaction is public and verifiable on the blockchain.

- Security: Uses cryptographic algorithms that make it extremely secure.

- Borderless Payments: Bitcoin can be sent anywhere in the world within minutes.

Why Bitcoin Is Called “Digital Gold”

Like gold, Bitcoin is scarce and valuable. Investors often buy it as a hedge against inflation and currency devaluation. Its limited supply and increasing adoption make it a potential store of value in the digital age.

Advantages of Using Bitcoin

- Lower Transaction Fees: Especially for international transfers.

- Financial Inclusion: Anyone with internet access can use Bitcoin.

- Ownership Freedom: No one can freeze or confiscate your Bitcoin.

- Fast Transactions: Faster compared to traditional banking systems.

Risks and Challenges

Despite its advantages, Bitcoin faces challenges such as:

- Price Volatility: Bitcoin’s price can rise or fall sharply.

- Regulatory Issues: Many governments are still figuring out how to regulate cryptocurrencies.

- Scams and Fraud: Users must be cautious about fake exchanges or phishing schemes.

Future of Bitcoin

Bitcoin continues to evolve as more companies and countries adopt it. Major brands now accept Bitcoin as payment, and institutional investors see it as a valuable digital asset. With growing awareness and blockchain innovation, Bitcoin’s role in the global financial system may become even stronger.

Conclusion

Bitcoin has transformed the way we think about money. It’s not just a digital currency — it’s a movement toward financial freedom and decentralization. Whether you’re an investor, trader, or tech enthusiast, understanding Bitcoin is essential in today’s digital economy.