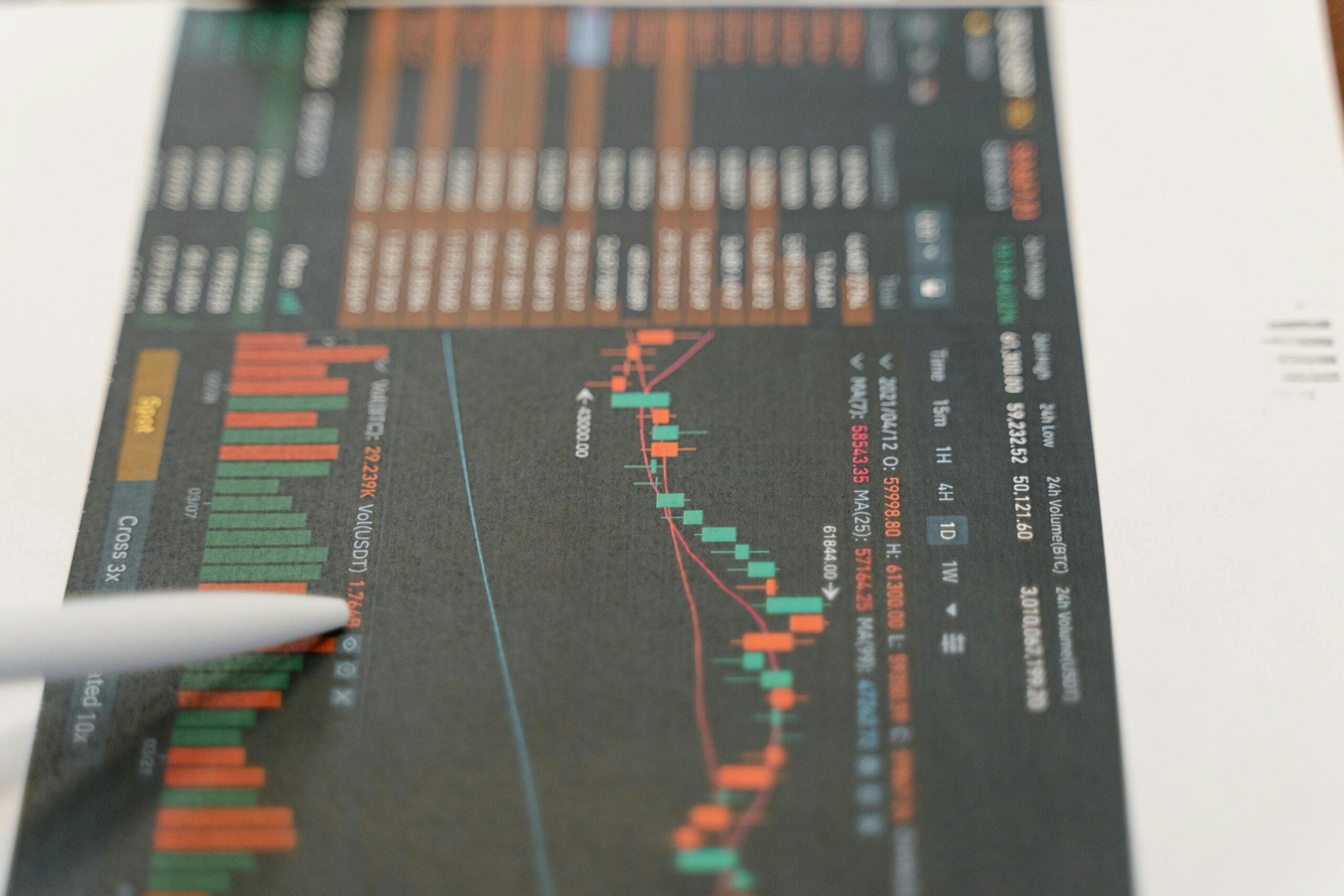

💡 Introduction: The Power of Indicators in Trading

In the world of crypto and stock trading, understanding price charts alone is not enough. Markets are driven by emotion, volume, and hidden momentum — all of which can be revealed through technical indicators.

Indicators are mathematical formulas based on price, volume, and time, helping traders make informed decisions instead of emotional ones. Whether you’re a beginner or an advanced trader, mastering these tools can significantly improve your success rate.

Let’s explore the most powerful and widely used indicators that every trader should know.

📈 1. Moving Averages (MA)

Moving Averages smooth out price fluctuations to help identify trends over a specific time frame.

🔹 Types of Moving Averages:

- Simple Moving Average (SMA): Calculates the average closing price over a given period (e.g., 50-day or 200-day SMA).

- Exponential Moving Average (EMA): Gives more weight to recent prices, reacting faster to new trends.

💡 How Traders Use It:

- If the price is above MA, it signals an uptrend.

- If the price is below MA, it suggests a downtrend.

- The Golden Cross (50 MA crosses above 200 MA) is often seen as a bullish signal, while the Death Cross indicates bearish momentum.

⚖️ 2. Relative Strength Index (RSI)

RSI measures the strength and speed of price movements on a scale of 0–100.

🔹 Key Levels:

- Above 70: Overbought (possible trend reversal or correction ahead).

- Below 30: Oversold (potential bounce or recovery).

💡 Why It Matters:

RSI helps traders identify entry and exit points and prevent emotional buying or selling during volatile markets.

📊 3. Moving Average Convergence Divergence (MACD)

MACD is one of the most popular momentum indicators used to detect trend changes and momentum strength.

🔹 Components:

- MACD Line (12 EMA – 26 EMA)

- Signal Line (9 EMA of MACD Line)

- Histogram (difference between MACD and Signal Line)

💡 How to Read It:

- When the MACD line crosses above the Signal line, it’s a bullish signal.

- When it crosses below, it’s a bearish signal.

- The histogram shows the momentum strength — the larger the bars, the stronger the trend.

📉 4. Bollinger Bands

Bollinger Bands measure volatility and price extremes by plotting bands around a moving average.

🔹 Structure:

- Middle Band: 20-day Simple Moving Average

- Upper Band: +2 standard deviations

- Lower Band: -2 standard deviations

💡 Interpretation:

- Price touching the upper band: Overbought zone.

- Price touching the lower band: Oversold zone.

- Band squeeze: Indicates low volatility and potential upcoming breakout.

🌀 5. Fibonacci Retracement

Fibonacci Retracement uses mathematical ratios to identify potential support and resistance levels.

🔹 Common Levels:

23.6%, 38.2%, 50%, 61.8%, and 78.6%

💡 How Traders Use It:

After a major price move, traders use Fibonacci lines to predict pullback levels where the price may temporarily reverse before continuing its trend.

🧭 6. Volume Indicator

Volume confirms the strength of price movements. A rise in volume often means the trend is genuine and supported by traders.

- Price ↑ + Volume ↑: Strong bullish move.

- Price ↑ + Volume ↓: Weak rally (possible reversal).

⚙️ Combining Indicators for Accuracy

Professional traders rarely rely on a single indicator.

A good strategy is to combine 2–3 indicators for more reliable signals:

✅ Example:

- MA (trend direction) + RSI (momentum) + MACD (confirmation)

This combination helps identify trend direction, market strength, and entry timing accurately.

💬 Conclusion: Mastering the Art of Chart Reading

Technical indicators are not magic tools — they are decision aids that work best when combined with discipline, patience, and risk management.

By mastering MA, RSI, MACD, Bollinger Bands, and Fibonacci, traders can gain deeper insights into market psychology and make more confident investment choices.